These are the stats for the last 7 days in New Westminster for "attached homes" (apartments and townhomes.)

New Listings: 68

Back on Market Listings: 3

Price Changes: 26 (All but 2 were downward price changes)

Sold Listings: 38

Listings/Sales Detail Changes: 26

These are the stats for the last 7 days in New Westminster for "detached homes" (houses.)

New Listings: 17

Back on Market Listings: 0

Price Changes: 4 (All were downward price changes)

Sold Listings: 10

Listings/Sales Detail Changes: 5

Thursday, May 22, 2008

Saturday, May 17, 2008

Do Teaser Rates Really Save You Money?

An update to the mortgage rates post:

One of our clients asked whether it was worth getting a "teaser" rate from the mortgage company. I did the calculations on some of the teaser rates that are being offered right now on variable rate mortgages of a 5 year term. I've used 40 year amortization to "amplify" the differences...

Example:

$150,000 mortgage

1) 3.00% for six months and then 4.35% for the remainder of the 5 year term versus,

2) 3.45% for 10 months and then 4.35% for the remainder of the 5 year term versus,

3) 4.15% for the entire 5 year term.

Scenarios 1 and 2 were almost exactly the same on the amount of interest saved for the teaser period (approximately $750) but both scenarios would be significantly more expensive in interest than just taking the rate in Scenario 3 for the entire term of the loan.

You would have paid almost $800 less interest and therefore paid $800 more down on your principal over the 5 year term.

The only comparison that remains to be done is if you took advantage of the teaser period to pay down more principal until the period is over. First, the bank must give you the flexibility to do so and secondly, you must have the discipline to do so.

The take-home message is:

In some cases.. TEASER RATES ARE CREATED TO FOOL YOU INTO PICKING A PRODUCT THAT COSTS YOU MORE MONEY IN THE LONG RUN!

One of our clients asked whether it was worth getting a "teaser" rate from the mortgage company. I did the calculations on some of the teaser rates that are being offered right now on variable rate mortgages of a 5 year term. I've used 40 year amortization to "amplify" the differences...

Example:

$150,000 mortgage

1) 3.00% for six months and then 4.35% for the remainder of the 5 year term versus,

2) 3.45% for 10 months and then 4.35% for the remainder of the 5 year term versus,

3) 4.15% for the entire 5 year term.

Scenarios 1 and 2 were almost exactly the same on the amount of interest saved for the teaser period (approximately $750) but both scenarios would be significantly more expensive in interest than just taking the rate in Scenario 3 for the entire term of the loan.

You would have paid almost $800 less interest and therefore paid $800 more down on your principal over the 5 year term.

The only comparison that remains to be done is if you took advantage of the teaser period to pay down more principal until the period is over. First, the bank must give you the flexibility to do so and secondly, you must have the discipline to do so.

The take-home message is:

In some cases.. TEASER RATES ARE CREATED TO FOOL YOU INTO PICKING A PRODUCT THAT COSTS YOU MORE MONEY IN THE LONG RUN!

Friday, May 16, 2008

May 16, 2008: Updated Mortgage Rates

May 16th – 5 year rates as low as 5.15% (offered by ING for mortgages submitted prior to end of the month). Lenders are now advertising low rates, but most come with conditions like “must close in 30 days” or have reduced features. These are good offers, as long as they meet the requirements of the borrower. Macquarie is offering 4.99% on a five year fixed term for mortgages over $500,000.

RATES:

Variable:

Prime = 4.75% (Next announcement date is June 10th)

- Prime minus 0.75% (currently 4.15%) 5 year term

- Prime minus 1.75% (currently 3.00%) for the first 6 months, prime less 0.40% (currently 4.35%) for remainder of term

Fixed:

1yr – 4.90% 2yr - 5.24% 3yr - 5.25% **5yr - 5.39% ***7yr – 5.95% 10yr - 6.15%

** Lenders offering rates of 5.15% 5 year fixed term - - applications submitted in May

** Lenders offering rate of 5.19% on 5 year term – reduced prepayment privileges.

*** 5.29% available on 7 year fixed term - quick close 45 days.

Payment per $100,000 mortgage @ 5.39% fixed rate

- 25 year amortization: $604.00

- 30 year amortization: $557.20

- 35 year amortization: $525.96

- 40 year amortization: $504.28

Payment per $100,000 mortgage @ 4.15% variable rate

- 25 year amortization: $534.00

- 30 year amortization: $484.04

- 35 year amortization: $449.67

- 40 year amortization: $425.09

Remember, the longer the amortization period, the less you will pay off of the principal in a 5 year term!

Please feel free to call us for our recommended mortgage brokers.

RATES:

Variable:

Prime = 4.75% (Next announcement date is June 10th)

- Prime minus 0.75% (currently 4.15%) 5 year term

- Prime minus 1.75% (currently 3.00%) for the first 6 months, prime less 0.40% (currently 4.35%) for remainder of term

Fixed:

1yr – 4.90% 2yr - 5.24% 3yr - 5.25% **5yr - 5.39% ***7yr – 5.95% 10yr - 6.15%

** Lenders offering rates of 5.15% 5 year fixed term - - applications submitted in May

** Lenders offering rate of 5.19% on 5 year term – reduced prepayment privileges.

*** 5.29% available on 7 year fixed term - quick close 45 days.

Payment per $100,000 mortgage @ 5.39% fixed rate

- 25 year amortization: $604.00

- 30 year amortization: $557.20

- 35 year amortization: $525.96

- 40 year amortization: $504.28

Payment per $100,000 mortgage @ 4.15% variable rate

- 25 year amortization: $534.00

- 30 year amortization: $484.04

- 35 year amortization: $449.67

- 40 year amortization: $425.09

Remember, the longer the amortization period, the less you will pay off of the principal in a 5 year term!

Please feel free to call us for our recommended mortgage brokers.

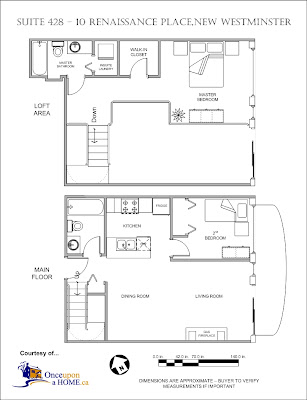

Yaletown-style Loft in New Westminster Quay!

Bright and spacious 1045 square foot, 2 bedroom and 2 bathroom loft by the Fraser River. Beautiful river and city views from the floor-to-ceiling, 17 foot high windows!

A sleek, modern kitchen with double-nosed granite countertops and stainless steel appliances awaits your culinary masterpiece.

Check-out all the pictures, floorplans and a virtual tour at onceuponahome.ca

Subscribe to:

Posts (Atom)